Governance

Basic Corporate Governance Approach

Practicing effective corporate governance is a key part of corporate social responsibility. Good governance enhances management efficiency and transparency, and it helps keep corporate value growing.

The ARE Holdings Group's practice of corporate governance seeks to earn the confidence of shareholders, business partners, employees, local communities, and other important stakeholders. In addition to fulfilling the social mission and responsibilities of a publicly listed company, we aim to keep growing corporate value by maintaining a corporate governance system that can quickly respond to changes in the business environment while always securing compliance.

Corporate Governance Policy

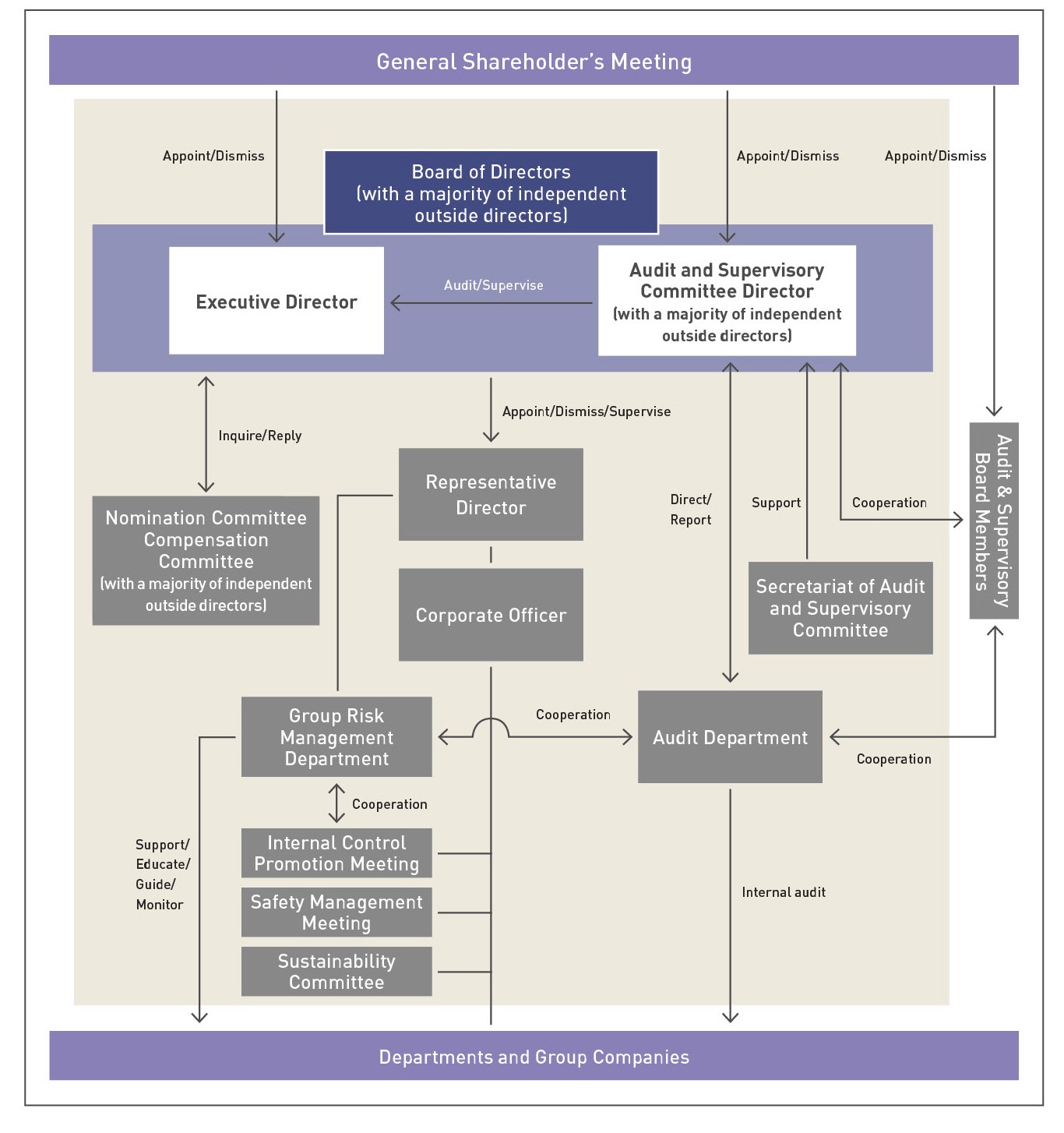

Corporate Governance Structure

Organization Design

- Board of Directors

- The Board of Directors is comprised of Executive Directors who are knowledgeable concerning their respective business, technical or administrative divisions, as well as Outside Directors with various types of expertise essential to corporate management. To enhance the neutrality and independence of the Board of Directors and have an adequate number of Directors for active, substantial and effective discussions at meetings, the majority of members on the Board of Directors are Outside Directors and it consists of six (6) Directors, including four (4) Independent Outside Directors. All Directors share their opinions actively and freely on important subjects such as the Group's management strategies and business plans.

- Outside Directors

- Independence Criteria have been established, and Independent Outside Directors with capacity to perform their duties independently from the management of the Company have been appointed, taking into consideration their individual backgrounds and relationships with the Group. They attend Board of Directors meetings and fulfill their roles and responsibilities as Directors. Whenever possible, they also attend the executive and management committee meetings of Group companies. As part of their wide-ranging activities, the Outside Directors share their opinions from an independent point of view. Moreover, the Head of Independent Outside Director is elected from among the Outside Directors so as to further strengthen cooperation between Independent Outside Directors and Executive Directors, and to establish a system that enables smooth communication and coordination.

- Evaluating the Effectiveness of the Board of Directors

- Since the fiscal year ended March 31, 2016, ARE Holdings started the evaluation of the effectiveness of the Board of Directors to see whether the entire Board of Directors functions appropriately.

Evaluating the Effectiveness of the Board of Directors in FY2024.3(41KB)

- Audit and Supervisory Committee

- Under Japan's Companies Act, ARE Holdings has elected to be a company with an Audit and Supervisory Committee, and has three Independent Outside Directors. This structure has strengthened the supervisory function of the Board of Directors. It also delegates important business execution to the Executive Directors for quicker decision-making and improved management efficiency.

- Nominating and Compensation Committees

- A Nominating Committee, consisting of three (3) members including two (2) Independent Outside Directors, as well as a Compensation Committee, have been established as advisory bodies to the Board of Directors, and the Chairman of the both Committees is elected from among Independent Outside Directors. The aim is to further enhance corporate governance by ensuring transparency, fairness, and objectivity for the appointment and dismissal of Directors and key management team members, as well as for the determination of director remuneration.

- Adherence to Japan's Corporate Governance Code

- The ARE Holdings Group adheres to all the principles of Japan's Corporate Governance Code formulated by the Tokyo Stock Exchange. The "Corporate Governance Report" with the 78-point code compliance, submitted to the Tokyo Stock Exchange, is available on our web site. In addition, we have formulated the ARE Holdings Corporate Governance Policies and are implementing each one to continuously enhance corporate governance.

- Maintaining an Internal Control System

-

Aiming to reinforce internal controls, we have established an Audit and Supervisory Committee within the Board of Directors. It includes four (4) Independent Outside Directors, and it cooperates with our Audit Department.

The Audit Department assesses the appropriateness and effectiveness of operations, while also auditing compliance with laws, regulations, and company rules. It advises and makes recommendations to each department, and promptly reports to senior management. In addition, trained staff in each department conduct internal audits based on an annual plan and report their findings to the Internal Control Promotion Meeting.

Board Skills Matrix

Remuneration for Directors

- Policy for determining the details of director compensation

- ・Remuneration policy determination

The Board of Directors requests the volunteer Compensation Committee, which consists of three board members, including two independent outside directors, to draft a recommendation for remunerating the directors of ARE Holdings. Based on this recommendation, the Board of Directors determines a policy detailing remuneration for each director. - ・Overview of the remuneration policy

Director compensation must be within the limits approved by the General Meeting of Shareholders. The Board of Directors determines the specific director compensation policy within these limits, based on the recommendation from the Compensation Committee, which plays an advisory role. The remuneration system is designed to motivate directors to improve the Group's business performance. Their remuneration consists of basic compensation, bonuses, and performance-linked stock-based compensation. However, directors who are Audit and Supervisory Committee members receive only basic compensation.